Veterans Legal Assistance Registry

assistance registry veterans wallpaperOur veterans risk their lives to keep our country safe and free. Veterans Legal Services provides assistance to veterans living in Massachusetts.

Were grateful to Rep.

Veterans legal assistance registry. June 6 2019 Family Law Attorneys LAST NAME FIRST NAME BUSINESS ADDRESS OFFICE PHONE OFFICE EMAIL Prior Service Pro Bono Reduced Rate Arnold Christopher 3018 W Horatio St. Veterans Legal Services mission is to promote self-sufficiency stability and financial security of homeless and low-income veterans through free and accessible legal services. Ohio veterans and their families can take advantage of various discounts and incentives for state parks and recreational activities.

In accordance with NRS 417090 1 k. The VA Veterans Justice Outreach Specialist at the closest VA Medical Center may be another source of information about the clinics. Travis Cummings and Sen.

First to gather and disseminate information share expertise and advise the members of the Bar on all matters relating to the practice of military law in Florida and second to have general jurisdiction regarding any problem which may arise relative to the provision of legal services to for or by members of the military establishment. The scope and function of the Military Veterans Affairs Committee is twofold. MVAC Veterans Legal Assistance Registry VLAR Last Updated.

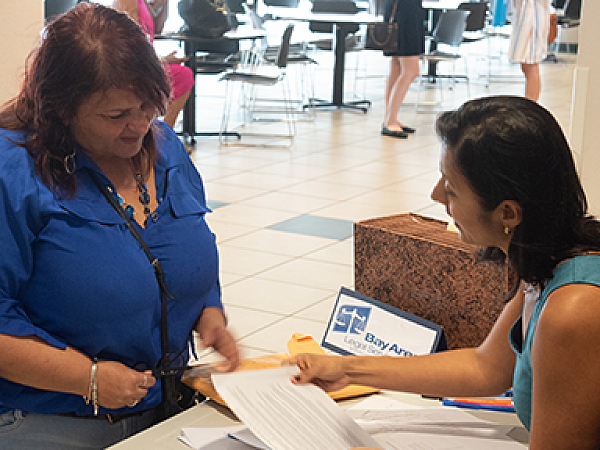

Rob Bradley for their support of this initiative which will provide our states veterans the civil legal aid they often need and richly deserve said JALA CEO Jim Kowalski. Jacksonville Area Legal Aid recently held a ribbon-cutting for its new Veterans Legal Services unit which is connected to a new statewide Florida Veterans Legal Helpline funded through the Florida Department of Veterans Affairs. We coordinate access to legal services for veterans through direct referrals to attorneys and legal aid organizations.

Many states such as Washington have laws in place that protect veterans and military service members from discrimination based on their military status. To noon and from 1 pm. We honor and support our veterans and their families through equal access to justice.

These benefits include pension education disability compensation home loans life insurance vocational rehabilitation survivor support medical care and burial benefits. February 25 2019 Veterans Benefits Disability Claims Attorneys. 200 Tampa FL 33614.

April 26 2019 Consumer Protection Credit Counseling Attorneys. Help and support when a veteran or service person dies 31. Appointments can be scheduled Monday through Friday from 8 am.

The Veterans Legal Aid Society funded by private donors is an awarded program available to indigent veterans and their families who are residents of the State of Illinois with financial need who require the assistance of an attorney. Army Yes Yes Kasten Christopher 1801 N. The VA is responsible for administering benefit programs for veterans their families and their survivors.

As part of its efforts the Office of Military and Veteran Legal Assistance identifies programs and maintains the following registry so that military service members and Veterans have a single source of information about the various legal assistance resources uniquely available to them. And we assist in the management of an OBRA Trust to benefit veterans and their families. Centonzio Javier 8240 118th Ave.

We support veterans legal aid programs. More specifically below you will find. To schedule an appointment with a Veterans Service Officer please call 239-533-8381.

MVAC Veterans Legal Assistance Registry VLAR Last Updated. Veterans and active-duty military personnel who need legal assistance may directly contact a lawyer through this registry. Housing assistance provides rental assistance vouchers for qualified veterans to use to get acceptable housing.

The Military Veterans Affairs Committee Legal Assistance Registry includes attorneys who may be available to assist veterans and active-duty personnel. Create and maintain a registry of governmental agencies and private entities that provide services and resources to veterans service members and their families and publish a digital copy of the registry on the Internet website maintained by the Department. LAST NAME FIRST NAME BUSINESS ADDRESS OFFICE PHONE OFFICE EMAIL Prior Service Pro Bono Reduced Rate.

June 7 2019 Commercial General Civil Litigation Attorneys LAST NAME FIRST NAME BUSINESS ADDRESS OFFICE PHONE OFFICE EMAIL Prior Service Pro Bono Reduced Rate Alvarez Manuel 109 N Brush St Ste 500 Tampa FL 33602. You must adhere to the following application guidelines in order to qualify for full consideration. Help and support for service leavers and veterans from the Veterans Welfare Service Defence Transition Services and other organisations.

MVAC Veterans Legal Assistance Registry VLAR Last Updated. To find more resources please visit our Veterans Resources page. Get legal help if you suspect you have been discriminated against.

The MVAC Military and Veterans Affairs Committee Veterans Legal Assistance Registry includes those attorneys who are licensed to practice in Florida and who may be available to assist veterans and active-duty personnel. LAST NAME FIRST NAME BUSINESS ADDRESS OFFICE PHONE OFFICE EMAIL Prior Service Pro Bono Reduced Rate. MVAC Veterans Legal Assistance Registry VLAR Last Updated.

Find a variety of information regarding legal assistance including help with military employment rights and domestic issues. Attorneys fee options may include a full fee arrangement a sliding fee scale a reduced rate or a pro bono or no charge basis. You may also contact your local VJO Specialist who may know of community resources for legal assistance.

You may also view our Veteran Services brochure below. The registry lists their areas of practice and contact information.